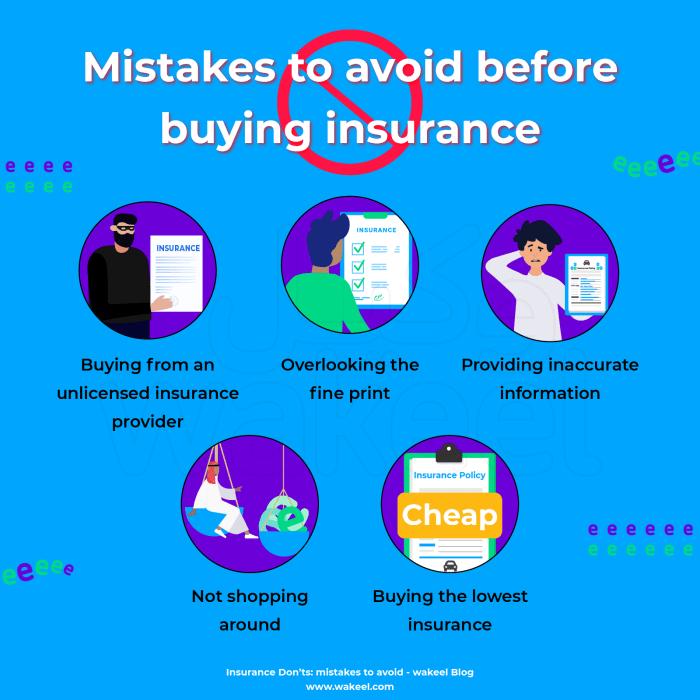

Delving into the realm of auto insurance shopping, it becomes evident that steering clear of common pitfalls is paramount. This guide aims to shed light on the crucial errors to sidestep, ensuring a smooth and informed decision-making process for all motorists.

Exploring the nuances of selecting the right auto insurance policy can be complex, but with the right approach, it can lead to substantial savings and optimal coverage.

Introduction to Auto Insurance Shopping

When it comes to owning a vehicle, having the right auto insurance is crucial. It not only protects you in case of accidents or damages but is also a legal requirement in most places. That's why shopping for auto insurance is an important task that should not be taken lightly.

By avoiding mistakes during the shopping process, you can ensure that you are getting the best coverage for your needs at a reasonable price. Making informed decisions and understanding the key factors involved in auto insurance shopping can save you time, money, and stress in the long run.

Key Factors to Consider when Shopping for Auto Insurance

- Coverage Options: Understand the different types of coverage available, such as liability, collision, and comprehensive, and choose the ones that best suit your needs.

- Premium Costs: Compare quotes from multiple insurance companies to find the most competitive rates without compromising on coverage.

- Deductibles: Consider how much you can afford to pay out of pocket in case of a claim and choose a deductible that aligns with your financial situation.

- Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for safety features on your vehicle, to maximize your savings.

- Customer Service: Research the reputation of the insurance company in terms of customer service, claims processing, and overall satisfaction to ensure a smooth experience when you need to file a claim.

Mistake 1: Not Comparing Multiple Quotes

When shopping for auto insurance, one common mistake is not comparing multiple quotes from different insurance providers. This step is crucial in finding the best coverage at the most affordable price.

Importance of Comparing Quotes

Comparing quotes allows you to see the range of options available to you in terms of coverage and pricing. Each insurance provider may offer different discounts, coverage limits, and rates, so exploring multiple quotes gives you a comprehensive view of what's out there.

- Check for coverage limits: Make sure the coverage offered by each provider meets your needs.

- Look for discounts: Some insurers offer discounts for safe driving, bundling policies, or being a loyal customer.

- Consider deductible amounts: The deductible amount can affect your premium, so compare this aspect as well.

- Review customer reviews: Get an idea of the customer service experience with each provider.

Mistake 2: Overlooking Coverage Limits and Deductibles

When shopping for auto insurance, one crucial aspect that should not be overlooked is understanding coverage limits and deductibles. These terms play a significant role in determining the financial protection you have in case of an accident.

Importance of Understanding Coverage Limits and Deductibles

Coverage limits refer to the maximum amount your insurance provider will pay for a covered claim. On the other hand, deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. By overlooking these factors, you may end up with inadequate coverage or higher financial risks in the event of an accident.

- For example, if you choose a low coverage limit and high deductible, you may have to pay more out-of-pocket in case of an accident, leaving you financially vulnerable.

- Conversely, opting for high coverage limits and low deductibles may lead to higher insurance premiums, impacting your overall budget.

- It is essential to strike a balance between coverage limits and deductibles that align with your financial situation and risk tolerance.

Mistake 3: Neglecting to Review Policy Exclusions

When shopping for auto insurance, it is crucial to thoroughly review the policy exclusions to avoid any surprises during claims. Policy exclusions Artikel specific situations or items that are not covered by your insurance policy, which can lead to unexpected expenses if overlooked.

Importance of Reviewing Policy Exclusions

- Policy exclusions help you understand the limitations of your coverage and prevent misunderstandings during claims.

- By reviewing exclusions, you can identify potential gaps in coverage and make informed decisions to fill those gaps with additional coverage options.

Common Policy Exclusions to be Aware of

- Wear and tear: Most auto insurance policies do not cover damage caused by regular wear and tear on your vehicle.

- Intentional damage: Any damage caused intentionally by you or someone else is typically not covered by insurance.

- Racing or reckless driving: Accidents that occur while participating in racing or reckless driving activities may not be covered.

- Unapproved use: If your vehicle is used for purposes not approved by the insurance policy, such as commercial use, it may not be covered.

Mistake 4: Failing to Consider Personal Factors

When shopping for auto insurance, it's crucial to take into account personal factors that can significantly impact your insurance rates. These factors include your driving record, location, and the type of vehicle you drive. Neglecting to consider these personal factors can result in higher premiums and inadequate coverage.

Importance of Personal Factors

- Your Driving Record: Insurance companies often assess your risk level based on your driving history. A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Location: Where you live can also affect your insurance premiums. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas.

- Vehicle Type: The make and model of your vehicle can impact your insurance rates. Sports cars or luxury vehicles may have higher premiums due to their higher repair costs.

Tips to Leverage Personal Factors for Better Rates

- Drive Safely: Maintaining a clean driving record by obeying traffic laws and avoiding accidents can help lower your insurance premiums.

- Consider Location: If possible, parking your car in a secure garage or investing in anti-theft devices can potentially reduce your insurance costs.

- Choose Wisely: When purchasing a new vehicle, consider the insurance costs associated with different makes and models. Opting for a car with good safety features can lead to lower premiums.

Mistake 5: Skipping Research on the Insurance Company

Before finalizing your decision on auto insurance, it's crucial to conduct thorough research on the insurance company itself. Skipping this step can lead to various issues down the road, affecting claims processing and customer service.

Importance of Researching the Insurance Company

When researching an insurance company, consider the following factors:

- Financial Stability: Check the company's financial strength ratings to ensure they can fulfill claims.

- Customer Reviews: Look for feedback from current and past customers to gauge customer satisfaction levels.

- Claims Processing: Investigate how efficiently and fairly the company handles claims.

- Coverage Options: Ensure the company offers the specific coverage options you need for your vehicle.

- Discounts and Rewards: Explore any discounts or rewards programs that could help you save on premiums.

Conclusive Thoughts

Conclusively, navigating the landscape of auto insurance shopping demands vigilance and foresight. By evading these five missteps, individuals are better equipped to secure a policy that aligns with their needs and safeguards their financial well-being.

Common Queries

Why is it important to compare multiple quotes?

Comparing multiple quotes allows individuals to assess different coverage options and prices, enabling them to make an informed decision based on their specific needs and budget.

What are some common policy exclusions to watch out for?

Policy exclusions can vary, but common ones include pre-existing conditions, intentional acts, and certain high-risk activities. Reviewing these exclusions is crucial to avoid unexpected expenses during claims.

How can personal factors affect insurance rates?

Personal factors such as driving history, location, and vehicle type can impact insurance rates significantly. Understanding how these factors influence premiums can help individuals secure better rates.