Embark on a journey of financial harmony with the guide on How to Plan Family Budgets Without Conflict. Delve into the intricacies of budgeting for families and discover the keys to a peaceful and prosperous financial future.

Explore the fundamental aspects of family budget planning and unlock the potential for financial stability and success.

Importance of Planning Family Budgets

Planning family budgets is crucial for ensuring financial stability and security for your family. It allows you to track your income and expenses, prioritize spending, and save for future goals.

Benefits of Having a Well-Thought-Out Budget

- Helps in managing cash flow effectively.

- Allows for better decision-making when it comes to spending.

- Reduces financial stress and uncertainty.

- Enables you to save for emergencies and long-term goals.

Positive Impact of Effective Budgeting

Effective budgeting can positively impact a family's financial situation in various ways:

- It can help in paying off debt faster by allocating resources efficiently.

- It can lead to increased savings for retirement or education funds.

- It can improve overall financial health and well-being of the family members.

- It can create a sense of financial discipline and responsibility among family members.

Setting Financial Goals

Setting financial goals is a crucial step in planning a family budget. It helps in providing a clear direction for managing finances effectively and achieving desired outcomes. By setting specific goals, families can work towards financial stability, savings, investments, and other aspirations.

Process of Setting Financial Goals

- Identify Short-Term and Long-Term Goals: Start by listing down both short-term goals (within a year) and long-term goals (beyond a year).

- Quantify Goals: Assign a specific amount or value to each goal to make it measurable.

- Prioritize Goals: Determine which goals are most important and need immediate attention.

- Set Realistic Timeframes: Allocate realistic timeframes for achieving each goal considering income, expenses, and other financial commitments.

Aligning Budgeting Goals with Family Needs

- Involve Family Members: Discuss financial goals with all family members to ensure that everyone's needs and aspirations are taken into account.

- Consider Individual Goals: Balance between individual goals and collective family goals to create a budget that satisfies everyone.

- Regular Review: Continuously review and adjust financial goals based on changing circumstances, new priorities, or unexpected expenses.

Importance of Realistic Goal-Setting

- Manage Expectations: Realistic goal-setting helps in managing expectations and avoiding disappointment if goals are not achieved within the expected timeframe.

- Track Progress: Setting attainable goals allows families to track progress, celebrate milestones, and stay motivated to continue working towards financial success.

- Adaptability: Realistic goals promote adaptability in budget planning, enabling families to make necessary adjustments without feeling overwhelmed or discouraged.

Tracking Income and Expenses

Managing a family budget involves closely monitoring both income and expenses to ensure financial stability and achieve set financial goals.

Tracking Income Sources

- Record all sources of income, including salaries, bonuses, side hustles, and any other earnings.

- Use a budgeting app or spreadsheet to track income regularly and accurately.

- Consider setting up automatic transfers to savings or investment accounts to ensure consistent savings.

Methods for Categorizing and Tracking Expenses

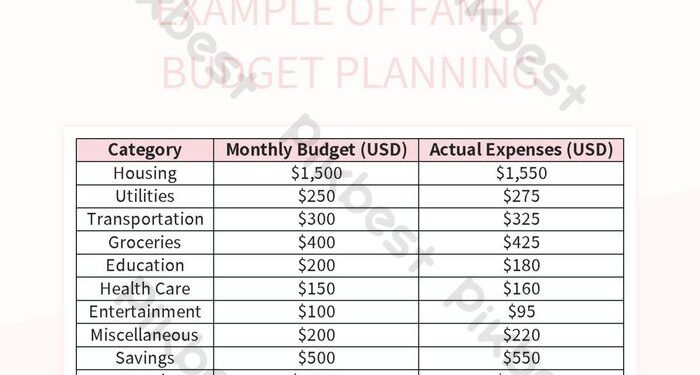

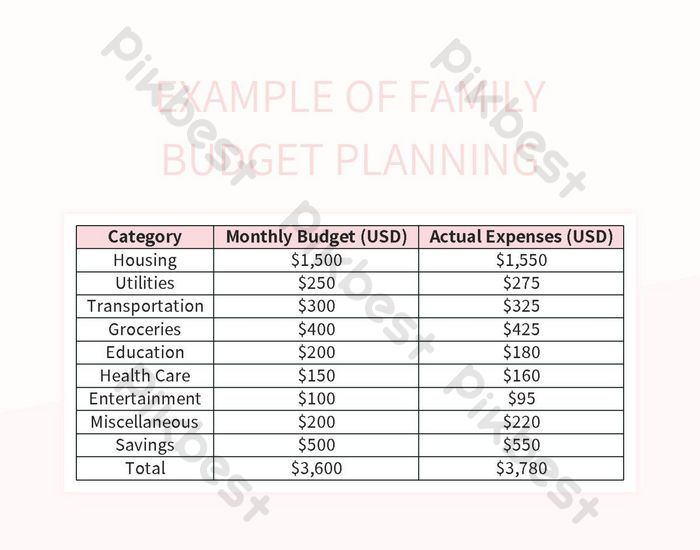

- Create categories for expenses such as housing, utilities, groceries, transportation, and entertainment.

- Keep all receipts and bills organized to easily track spending in each category.

- Use budgeting tools that allow for categorization and provide insights into spending habits.

Tips on Monitoring Spending Patterns

- Regularly review your expenses to identify areas where you can cut back or make adjustments.

- Compare your actual spending against your budgeted amounts to see if you are staying on track.

- Look for trends in your spending habits and make necessary changes to improve your financial situation.

Creating a Budgeting Strategy

When it comes to creating a budgeting strategy for your family, there are several key aspects to consider in order to ensure financial stability and harmony within the household.

Different Budgeting Methods

- Zero-Based Budgeting: This method involves assigning every dollar of income a specific purpose, ensuring that all funds are allocated and accounted for.

- Envelope System: With this approach, you divide your cash into different categories and place them in labeled envelopes to limit spending in each area.

Importance of Involving All Family Members

- It is crucial to involve all family members in the budgeting process to ensure transparency, shared responsibility, and a sense of ownership over financial decisions.

- By including everyone in the discussion, you can gather valuable input, perspectives, and priorities that will help create a more comprehensive and realistic budget.

Guidance on Creating a Flexible Budget

- Start by outlining your fixed expenses, such as rent, utilities, and debt payments, before allocating funds to variable expenses like groceries, entertainment, and savings.

- Consider setting aside a portion of your budget for unexpected expenses or emergencies to maintain financial resilience and avoid going off track during challenging times.

- Regularly review and adjust your budget based on changing circumstances, such as income fluctuations, new expenses, or shifting priorities, to ensure that it remains relevant and effective.

Managing Debt and Savings

When it comes to managing debt and savings within your family budget, it's essential to have a clear strategy in place. By prioritizing savings and effectively managing debt, you can secure your financial future and ensure stability for your loved ones.

Strategies for Managing Debt

- Start by creating a list of all your debts, including outstanding balances, interest rates, and minimum monthly payments.

- Consider consolidating high-interest debts into a lower interest loan to reduce overall interest payments.

- Develop a debt repayment plan, focusing on paying off high-interest debts first while making minimum payments on others.

- Avoid taking on new debt and cut back on unnecessary expenses to free up more money for debt repayment.

Significance of Prioritizing Savings and Emergency Funds

- Having an emergency fund is crucial to protect your family from unexpected financial setbacks like medical emergencies or job loss.

- Prioritizing savings allows you to build a financial cushion for the future, whether it's for retirement, education, or other long-term goals.

- By setting aside a portion of your income for savings each month, you can ensure financial security and peace of mind for your family.

Tips for Balancing Debt Repayment and Savings Goals

- Allocate a specific percentage of your income towards debt repayment and savings to ensure both goals are being met.

- Automate your savings and debt payments to avoid missing deadlines and ensure consistent progress towards your financial goals.

- Regularly review your budget to track your progress and make adjustments as needed to stay on track with both debt repayment and savings.

Communication and Conflict Resolution

Effective communication and conflict resolution are essential when it comes to planning family budgets. It's important to openly discuss finances within the family and address any conflicts that may arise regarding budget decisions. By fostering a collaborative approach to budget planning, families can avoid misunderstandings and work together towards financial goals.

Strategies for Open Communication

- Hold regular family meetings to discuss finances and budgeting goals.

- Encourage each family member to share their thoughts, concerns, and ideas about the budget.

- Use clear and simple language to explain financial concepts and decisions.

- Listen actively to each other's perspectives and be open to feedback.

- Set aside time to review the budget together and make adjustments as needed.

Addressing Conflicts

- Approach conflicts with a calm and understanding attitude.

- Identify the root cause of the conflict and discuss possible solutions together.

- Avoid blaming or criticizing each other; focus on finding a compromise.

- Seek the help of a financial counselor or mediator if needed to resolve conflicts.

Fostering Collaboration

- Set common financial goals as a family and work towards them together.

- Celebrate small victories and milestones achieved in the budgeting process.

- Recognize each family member's contributions to the budget and show appreciation.

- Create a positive and supportive environment for discussing finances and making decisions.

Outcome Summary

In conclusion, mastering the art of budgeting without conflict is not just about numbers; it's about communication, collaboration, and shared goals. With these insights, you're equipped to navigate the complexities of family finances with confidence and unity.

FAQ Corner

How can I involve my family members in the budgeting process?

Engage your family by discussing financial goals together, creating a budget plan collectively, and regularly reviewing expenses as a team.

Why is realistic goal-setting important in budget planning?

Realistic goals ensure that your budget is achievable and sustainable, preventing frustration and conflicts arising from unattainable expectations.

What are some effective strategies for managing debt within a family budget?

Strategies include prioritizing high-interest debt, consolidating loans where possible, and negotiating with creditors for better terms.

How can I foster open communication about finances within my family?

Encourage regular discussions about money matters, listen actively to each family member's perspective, and create a safe space for sharing financial concerns.