How to Find the Cheapest Auto Insurance with Full Coverage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the ins and outs of auto insurance coverage, understanding the factors that affect rates, and maximizing discounts all play a crucial role in finding the best deal.

Understanding Auto Insurance Coverage

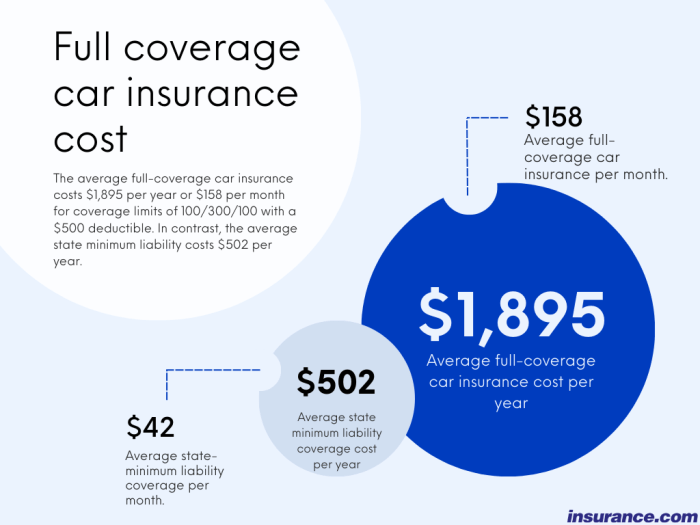

Auto insurance coverage is essential for protecting yourself and your vehicle in case of accidents or damages. Full coverage auto insurance is a comprehensive policy that offers a higher level of protection compared to basic coverage.

What does full coverage typically include?

- Liability coverage: This covers damages and injuries you cause to others in an accident.

- Collision coverage: This pays for damages to your vehicle in case of a collision.

- Comprehensive coverage: This covers non-collision damages, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you're in an accident with a driver who has insufficient insurance.

Importance of having full coverage versus basic coverage

While basic coverage may meet the legal requirements in your state, full coverage offers more extensive protection for you and your vehicle. In the event of a serious accident, full coverage can help cover costly repairs or medical expenses that basic coverage may not fully address.

It provides peace of mind knowing that you have comprehensive protection in various scenarios.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several key factors come into play. These factors can significantly impact how much you pay for your coverage. Understanding these influences can help you make informed decisions when shopping for auto insurance.

Personal Driving History

Your personal driving history is one of the most influential factors when it comes to determining your auto insurance rates. Insurance companies consider factors such as your driving record, including any accidents or traffic violations, when calculating your premiums. A clean driving record with no accidents or tickets typically results in lower insurance rates, as it suggests that you are a lower risk driver.

On the other hand, a history of accidents or violations can lead to higher premiums, as it indicates a higher risk of future claims.

Vehicle’s Make, Model, and Year

The make, model, and year of your vehicle also play a significant role in determining your auto insurance rates. Insurance companies take into account the cost of repairing or replacing your vehicle in the event of an accident when setting your premiums.

Generally, newer and more expensive vehicles will cost more to insure due to their higher replacement value. Additionally, certain makes and models may be more prone to theft or have higher repair costs, which can also impact your insurance rates.

Older vehicles, on the other hand, may be less expensive to insure due to their lower value and repair costs.

Researching Insurance Providers

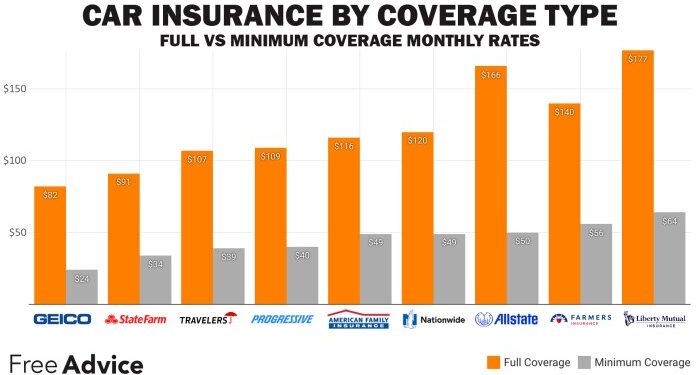

When looking for the cheapest auto insurance with full coverage, it is crucial to research different insurance providers thoroughly. Comparing quotes from multiple companies and checking customer reviews can help you make an informed decision.

Comparing Quotes

- Request quotes from at least three different insurance companies to compare prices.

- Make sure the quotes include the same coverage limits and deductibles for accurate comparison.

- Consider bundling your auto insurance with other policies, such as home or renters insurance, for potential discounts.

Checking Customer Reviews

- Look up customer reviews and ratings for insurance companies on independent websites or consumer review platforms.

- Pay attention to feedback on customer service, claims handling, and overall satisfaction.

- Avoid companies with a high number of complaints or negative reviews regarding claim denials or delays.

Maximizing Discounts and Savings

When it comes to getting the cheapest auto insurance with full coverage, maximizing discounts and savings can significantly lower your premiums. By taking advantage of common discounts and bundling options, you can save a substantial amount on your auto insurance policy.To qualify for discounts, insurance providers often consider various factors such as your driving habits, vehicle safety features, and other criteria.

By understanding these factors, you can tailor your insurance policy to maximize savings while still maintaining adequate coverage.

Common Discounts Available for Auto Insurance

- Good driver discount

- Multi-vehicle discount

- Good student discount

- Low mileage discount

- Safety feature discount

Qualifying for Discounts Based on Driving Habits or Vehicle Safety Features

- Install safety features such as anti-theft devices, airbags, and anti-lock brakes to qualify for discounts.

- Drive safely and maintain a clean driving record to be eligible for a good driver discount.

- Consider usage-based insurance programs that monitor your driving habits to potentially lower your premiums.

Bundling Options for Additional Savings on Auto Insurance Policies

- Bundle your auto insurance with other policies such as home or renter's insurance to receive a discount on both.

- Combine multiple vehicles under the same insurance policy to qualify for a multi-vehicle discount.

- Explore discounts for insuring multiple drivers in a household under the same policy.

Adjusting Coverage to Fit Budget

When looking to lower auto insurance premiums to fit within a budget, it's essential to consider adjusting coverage limits and deductibles. These changes can help balance the need for sufficient coverage with the desire to save money on insurance costs.

Strategies for Adjusting Coverage Limits

- Consider reducing comprehensive and collision coverage on older vehicles with lower market value.

- Review liability coverage limits to ensure they meet state requirements while still providing adequate protection.

- Evaluate personal injury protection (PIP) and medical payments coverage to determine if adjustments can be made based on individual health insurance coverage.

Implications of Raising Deductibles

- Raising deductibles typically leads to lower premiums, but it also means higher out-of-pocket costs in the event of a claim.

- Consider the financial impact of a higher deductible on your ability to pay for repairs or damages before choosing this option.

- Balance the savings from a higher deductible with your comfort level in managing potential higher costs after an accident.

Balancing Coverage Needs with Budget Constraints

- Regularly review your insurance needs and adjust coverage based on changes in circumstances, such as vehicle value, driving habits, or financial situation.

- Work with your insurance agent to explore different coverage options and find a balance that provides adequate protection without exceeding your budget.

- Consider bundling policies or taking advantage of discounts to offset the impact of adjusting coverage limits or deductibles.

Ultimate Conclusion

In conclusion, finding the cheapest auto insurance with full coverage requires a strategic approach that balances cost and coverage. By following the tips and information provided in this guide, you can navigate the complex world of auto insurance with confidence and ease.

Essential FAQs

What does full coverage auto insurance typically include?

Full coverage auto insurance usually includes liability, collision, and comprehensive coverage to protect you and your vehicle.

How can I qualify for discounts on auto insurance?

You can qualify for discounts based on factors like a clean driving record, bundling policies, or installing safety features in your vehicle.

What are some common discounts available for auto insurance?

Common discounts include multi-policy discounts, safe driver discounts, and discounts for certain vehicle safety features.