When it comes to Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, understanding the nuances between the two can make all the difference in choosing the right insurance for your vehicle. From deciphering the components of each to evaluating cost implications, this comparison sheds light on the intricacies of insurance coverage.

Auto Policy Quotes vs Full Coverage

When it comes to car insurance, understanding the difference between auto policy quotes and full coverage is crucial for making informed decisions. Auto policy quotes refer to the estimated cost of a specific insurance policy based on factors like the type of coverage, deductible amount, and the driver's profile.

On the other hand, full coverage typically includes liability, comprehensive, and collision coverage, providing more extensive protection for the insured vehicle.

Key Features of Auto Policy Quotes

- Based on factors like coverage type, deductible, and driver profile

- Provides estimated cost of the insurance policy

- Allows for customization based on individual needs and budget

Key Features of Full Coverage

- Includes liability, comprehensive, and collision coverage

- Offers more extensive protection for the insured vehicle

- Higher premium compared to basic auto policy quotes

Cost Implications of Auto Policy Quotes vs Full Coverage

Choosing between auto policy quotes and full coverage can have significant cost implications. While auto policy quotes may offer lower premiums initially, they may not provide adequate coverage in case of accidents or other unforeseen events. On the other hand, full coverage typically comes with higher premiums but offers more comprehensive protection, reducing out-of-pocket expenses in the event of a claim.

It's essential for drivers to weigh the cost implications against the level of protection needed to make an informed decision.

Understanding Auto Policy Quotes

When it comes to understanding auto policy quotes, it's important to know how insurance companies calculate these quotes, the factors that influence them, and how to interpret the information provided.

Factors Influencing Auto Policy Quotes

- Your Age: Younger drivers typically face higher insurance premiums due to their lack of driving experience.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower quotes.

- Type of Vehicle: The make and model of your car, its age, and safety features can impact the cost of your insurance.

Obtaining and Interpreting Auto Policy Quotes

- Process: To obtain auto policy quotes, you can reach out to insurance companies directly or use online comparison tools. You will need to provide information about yourself, your vehicle, and your driving history.

- Interpretation: When reviewing auto policy quotes, pay attention to the coverage limits, deductibles, and any optional add-ons offered. Make sure the policy meets your needs and budget.

Exploring Full Coverage Insurance

When it comes to auto insurance, full coverage is a term that is often used, but what does it really mean? Let's delve into the components of full coverage insurance and how it compares to basic auto insurance policies.

Defining Full Coverage Insurance

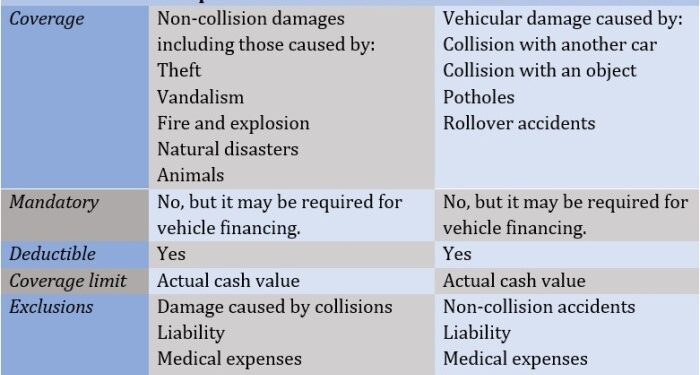

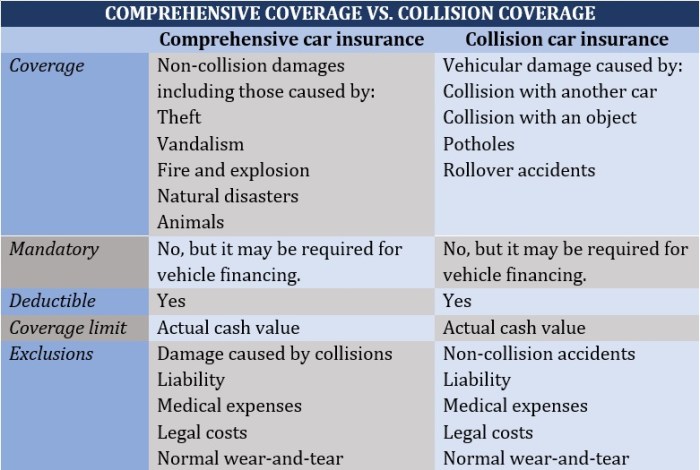

Full coverage insurance typically includes three main components: liability coverage, collision coverage, and comprehensive coverage.

- Liability coverage: This protects you in case you are at fault in an accident and covers the other party's medical expenses and property damage.

- Collision coverage: This covers the cost of repairs to your vehicle in case of a collision with another vehicle or object.

- Comprehensive coverage: This protects your vehicle from non-collision related incidents such as theft, vandalism, or natural disasters.

Benefits of Full Coverage Insurance

Opting for full coverage insurance provides more extensive protection compared to basic auto insurance policies.

- Peace of mind: Full coverage insurance can give you peace of mind knowing that you are protected in a variety of situations.

- Financial security: With comprehensive coverage, you are covered for a wider range of incidents that could result in costly repairs or replacement of your vehicle.

- Legal requirements: In some cases, full coverage insurance may be required by lenders if you have a car loan or lease.

When to Opt for Full Coverage Insurance

While full coverage insurance may come with a higher premium, there are scenarios where opting for it is recommended.

- New or valuable vehicle: If you have a new or valuable vehicle, full coverage insurance can help protect your investment.

- High-risk area: If you live in an area prone to accidents, theft, or natural disasters, comprehensive coverage can provide added security.

- Leased or financed vehicle: Lenders often require full coverage insurance for leased or financed vehicles to protect their investment.

Choosing the Right Coverage for Your Needs

Deciding between auto policy quotes and full coverage can be a crucial decision when it comes to protecting your vehicle and finances. It's essential to evaluate your individual circumstances to determine which option is more suitable for you.Factors such as budget, driving habits, and the value of your vehicle play a significant role in this decision-making process.

Here are some tips to help you strike a balance between adequate coverage and affordability:

Consider Your Budget and Financial Situation

Before choosing between auto policy quotes and full coverage, assess your budget and financial stability. Full coverage may provide comprehensive protection, but it comes with a higher premium. If your budget is tight, opting for auto policy quotes with basic coverage might be more feasible.

Evaluate Your Driving Habits and Risk Factors

Take into account your driving habits and the potential risk factors you face on the road. If you have a long commute or frequently drive in high-traffic areas, full coverage insurance could offer added peace of mind. On the other hand, if you have a clean driving record and minimal risk exposure, auto policy quotes might suffice.

Assess the Value of Your Vehicle

The value of your vehicle also plays a critical role in determining the right coverage. If you own a new or high-value car, full coverage insurance can protect you in case of accidents or theft. However, if your vehicle is older or has depreciated significantly, auto policy quotes with limited coverage might be a more cost-effective choice.

Last Word

In conclusion, Auto Policy Quotes vs Full Coverage: What’s the Real Difference? unravels the complexities of insurance choices, offering insights into making informed decisions based on individual needs and circumstances. With a better grasp of these options, drivers can navigate the insurance landscape with confidence and clarity.

FAQ Compilation

What factors influence auto policy quotes?

Factors such as age, driving record, type of vehicle, and location can all impact auto policy quotes.

What does full coverage insurance typically include?

Full coverage insurance usually includes liability, collision, and comprehensive coverage.

How can one determine whether auto policy quotes or full coverage is more suitable?

Consider factors like budget, driving habits, and the value of the vehicle to determine the most suitable coverage.